What began as a vision became a mission

About me

Name: Domenico Lagos

Investor Ranking: Elite Popular Investor

Trusted by: +1.220 Copiers

Assets Under Management: +$3.01m

Education

BSc Accounting & Finance at Athens University of Economics & Business (1st Class Honours - 8/10)

MSc Shipping, Trade & Finance at BAYES Business School (1st Class Honours - Distinction)

CISI Level 3 Certificate in Wealth & Investment Management (Merit - 91/100)

Short Bio

My name is Domenico Lagos, a Greek investor with a deep passion for the markets and over 8 years of hands-on experience. My journey began in 2017, focusing on Greek equities where I’ve consistently achieved annual returns exceeding 23% (excluding dividends).

Since joining eToro in 2020, I’ve expanded into international markets, building a high-conviction portfolio and investing solely my personal savings with a long-term horizon of at least 10-15 years.

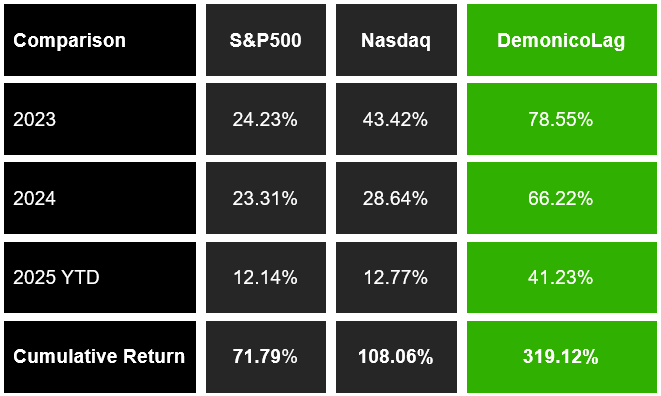

Today, I proudly hold the Elite Popular Investor status on eToro, with over $2.9m in AUM and 1.220+ copiers trusting my strategy. In 2023 and 2024, my portfolio delivered returns of 78.55% and 66.22%, significantly outperforming the broader market.

I approach investing with discipline, simplicity, and patience, always staying committed to learning and evolving. I'm not here to chase hype, I’m here to build wealth slowly, strategically, and sustainably.

Investing goal

Investing goal

My investment objective is to generate sustainable annual returns of minimum 15% by acquiring high quality stocks and pursuing diversification across both geographic areas and sectors. My passion for investing could not be any stronger and for this reason I am committed to create value for both myself and my eToro copiers.

Simplicity is my edge. Discipline is my engine.

The fewer the moves,

the greater the power.

Investing Strategy

Our strategy is to maintain a well-balanced portfolio of Value & Growth stocks. I invest the majority of our portfolio into stocks and a maximum of 5% of my total allocation to cryptos & commodities. I constantly seek undervalued opportunities, which are trading at attractive valuations and will grant me & my copiers consistent returns over time, outperforming the S&P500. My strategy is not complex. I try buying shares of unpopular companies when they look like road kill and stick with them during their recovery.

I focus on high-quality businesses with solid fundamentals and long-term growth potential. The goal is to build a resilient portfolio by selecting companies that demonstrate financial strength, strategic positioning, and a clear path to value creation. Risk management and capital preservation remain key priorities, while I avoid businesses that lack sustainability or clear competitive advantages.

Investing Horizon

I strongly believe that long-term investing is the most reliable path to building meaningful and sustainable wealth. My approach is centered around buying and holding high-quality businesses that have the potential to perform well over many years not weeks or months.

Short-term market movements, volatility, and corrections are inevitable but they are also irrelevant when the focus is on the underlying business performance over the next 10 to 15 years. By maintaining a long-term perspective, we avoid emotional decision-making, reduce the risk of mistimed trades, and benefit from the power of compounding returns over time.

History has shown that those who stay invested and committed to a clear strategy outperform those who constantly chase trends or attempt to time the market. My portfolio reflects this mindset. I invest my own savings alongside my copiers and remain fully dedicated to navigating both calm and stormy markets with discipline and patience.

This is not about chasing short-term gains, it's about owning a piece of the future.

It is important to understand that this is a long-term portfolio. If you are prepared to copy my account, you must be willing to leave your money invested for the long-term. This will allow you to see the real results of our positions. Your money will compound and the effects of volatility will be minimum.

Returns since becoming Popular Investor

Since becoming a Popular Investor in 2023, I’ve remained laser-focused on the above strategy and the numbers speak for themselves.

In 2023, my portfolio delivered an outstanding +78.55% return, driven by bold but calculated decisions during key market moments.

In 2024, despite a volatile environment, I stayed disciplined and closed the year with a strong +66.22%, significantly outperforming the broader market once again.

Year-to-date 2025 is shaping up to be an exceptional year, with our portfolio already delivering a solid +41.23% return as of September 29th, all while keeping risk at a minimum.

This journey is not about luck, it’s about strategy, patience, and knowing when to act when others hesitate.

If you're looking for a proven, resilient approach to growing capital you’re in the right place.